The Credit Bureau Singapore not only provides credit data information to consumers, but also credit reports to eligible companies for employee credit assessments, to help them make well-informed hiring decisions. This is especially relevant for banks and financial institutions as they are closely regulated by the Monetary Authority of Singapore (MAS).

Under MAS’s Guidelines on Fit and Proper Criteria, be it an institution, exempt financial institution, exempt entity or a fund management company, employers are obligated to do employment checks, including credit checks, on pre-hires to evaluate their overall credit health and financial stability.

Now, let us now dive deeper into some of the common questions and misconceptions that jobseekers will have of hirers who conduct an employment credit check on them.

Common misconceptions of Employment Credit Checks

1. All companies will conduct Employment Credit Checks

False. For companies who are not required to comply with MAS’s regulations, they might choose to not conduct Employment Credit Checks for all their employees.

2. Companies only conduct the check for new/pre-hires only

False. Companies who are complying with MAS’s regulations may also conduct annual review checks on all or some of their existing employees.

3. All employers are able to request a copy of my Credit Report from CBS

False. Only selected authorised companies are allowed to obtain a copy of your credit report, subject to CBS’s review. The companies must also ensure that the necessary authorisation and consent have been obtained from the candidate before CBS is allowed to release the Credit Report to the requested company.

Candidates also can dispute the findings of the credit report if they disagree with the data.

4. Employers only conduct Credit Assessment Checks for high-ranking officials such as managers and above

False. Depending on the risk appetite of each company, some may choose to conduct employment screenings for employees who hold a certain level of responsibility. For example, a company accountant who assists in overlooking the company’s assets and finances, or a relationship manager who handles clients’ wealth assets.

5. If I have a poor Credit Score, employers will be less likely to consider me

False. The Credit Score is a fluid number which may change from time to time in tandem with changes in your credit information. This is only one of the many indicators that employers will look out for. There is other information in your Credit Report that may be taken into consideration, such as Public Record, Account Status History and Default Records.

Your Credit Score will gradually improve over time as you continuously make good repayment efforts to clear your bills and loans on time. Also, do take note that the Credit Report is only one of the many tools that employers will use to assess your overall suitability for the role.

6. My past information will be reflected on my Credit Report forever

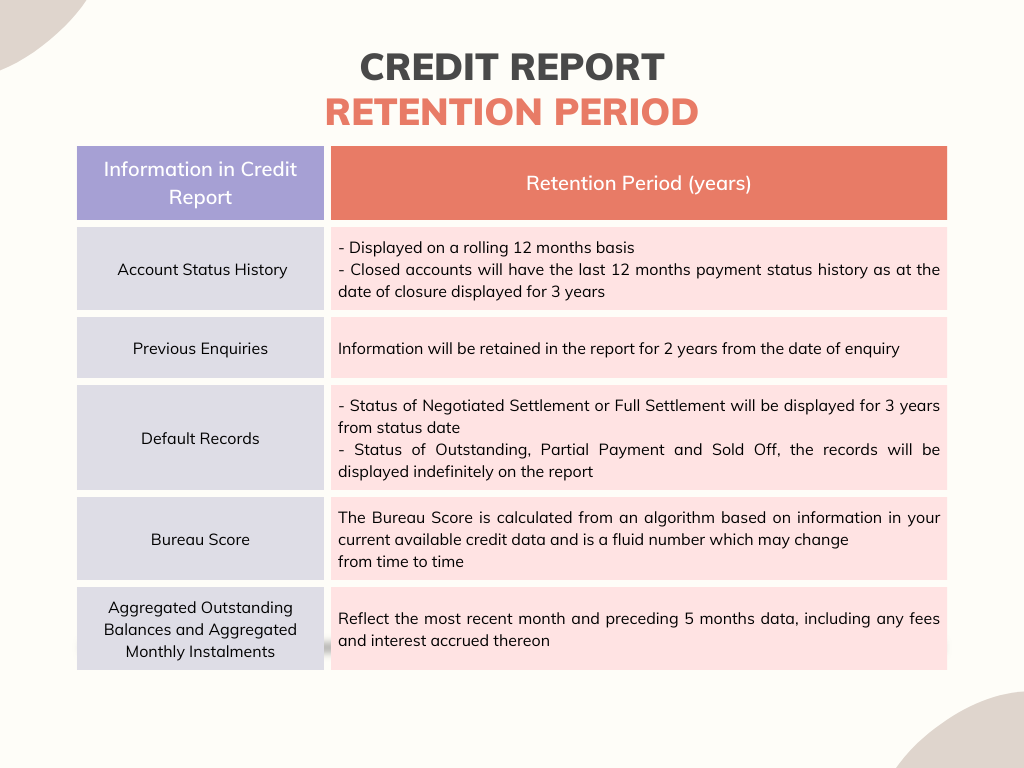

False. Your outdated information on your Credit Report will be purged after several years as shown below:

Consistency is key

Do not fret or panic if you feel that your credit score is not up to expectations just yet. Always remember that performing your due diligence and repaying all your bills on time is key to building a good credit score. Not only does this look better when you are job hunting, but it also makes you seem like a more credible and responsible borrower when you apply for loans in the future.

Should you have any questions about your credit report, please contact our friendly Consumer Services Officers at 6565 6363 or email consumer_services@creditbureau.com.sg.

This article is contributed by Credit Bureau Singapore.

![]()