Uncertain times may lie ahead in 2024, especially with the ongoing challenges such as the unresolved situation in Ukraine and some slowdown in China’s growth.

Factors such as these led the private sector to lower their growth forecast for 2023 to 1.4%, according to a survey by the Monetary Authority of Singapore (MAS). The Singapore economy also expanded by 0.5% year-on-year as of Q2 2023, below previous survey median forecasts of 1.5%.

Nonetheless, some economists believe that the end of this year’s manufacturing downturn may be in sight.

Coupled with potential upside drivers such as capital inflows into Singapore and easing inflation, there was a broad consensus for 2024’s economic forecast to be around 2.5% year-on-year, especially compared to 2023’s lowered figures.

Are salary increments for Singapore workers in 2024 still likely?

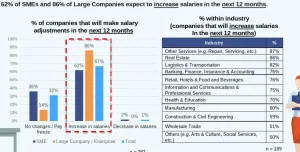

Such slight sentiments of positivity could be the reason why the Singapore Business Federation’s (SBF) Survey on Manpower and Wages, conducted in July 2023, showed most Singapore employers are still planning to offer workers salary rises in 2024.

In total, 64% of the 282 businesses surveyed – comprised of small and medium enterprises (SMEs) and large companies across all major industries – planned to increase wages with an average increment of 6%.

On the other hand, another 32% are planning to maintain current wages, with 1% looking to implement pay cuts.

Associate Professor Walter Theseira, an economist at the Singapore University of Social Sciences, said to the Straits Times: “The main driver of wage increases really is the need to keep staff, given the tight labour market and the inflationary environment that effectively results in real wage reductions if wages remain stagnant.

“You see that all sectors generally plan to have wage increases, including sectors with somewhat pessimistic outlooks for revenue or the economy.

“I think this is a recognition that without the wage hikes, the firms don’t see that it will be possible to retain their existing staff or recruit more.”

There are over 100,000 jobs available on MyCareersFuture. Apply for your next job role here!

But salary increments will be dependent on the industry outlook

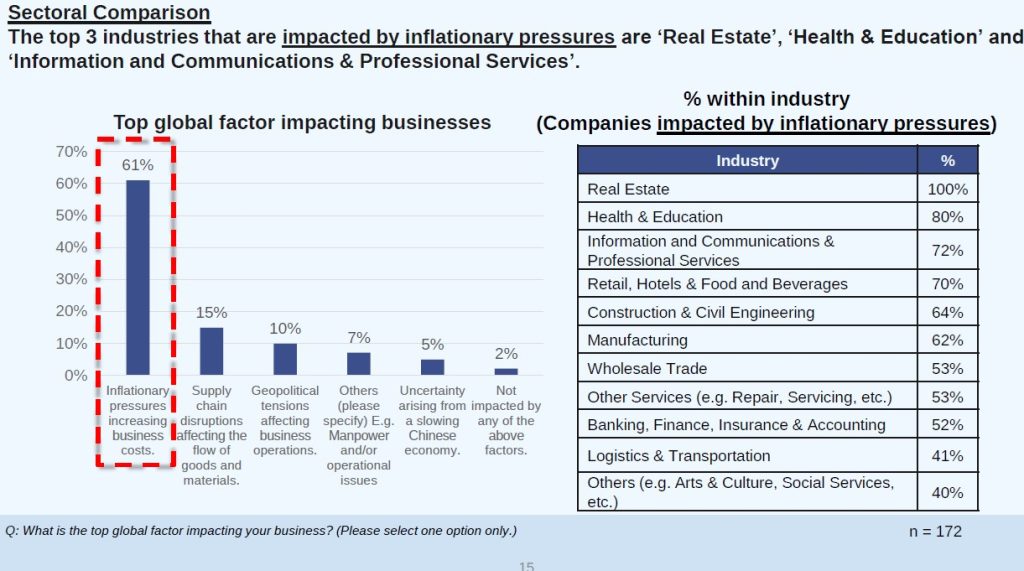

But of course, not all employers have the ability to raise wages, with inflation and increased business costs hitting different industries in various ways.

The SBF survey showed that 85% of companies are expecting costs to go up, with 42% of SMEs expecting an increase of 10-25%, while 45% of larger companies projecting their costs to increase by up to 10%.

The survey showed that the three industries citing increased business costs as a concern were companies in real estate (100%), health and education (80%), and information and communications/professional services (72%).

Headed into the last quarter of 2023, the MAS survey, which polled 24 economists and analysts who monitor the local economy, pegged growth for the finance and insurance industry to shrink to 1.3%, compared to previous forecasts of 2.5%, while growth in the wholesale and retail trade is expected to drop to 0.8% compared to 1.9% projected earlier in the year.

On the upside, construction is expected to grow 7%, compared to the previous quarter’s estimate of 4.2%, and accommodation and food services could show 10% growth, compared to the earlier estimates of 8.4%.

Mr Kok Ping Soon, chief executive officer of SBF, concluded: “There are sectors that expect to do well just as there are sectors that will continue to face headwinds.

“Hence, differentiated and sustainable wage growth that keeps with the underlying productivity growth of the sectors is important.”