What is a credit report?

A credit report is a comprehensive record of your credit payment history compiled from different retail banks and major financial institutions. Credit Bureau Singapore (CBS) collects such credit data from the contributing members in this list.

Who uses the credit report?

Both credit providers and employers may use this credit report to conduct credit assessments of an individual. Credit providers use this to evaluate the likelihood of the consumer repaying before extending a loan out to him/her, to lessen the risks of individuals defaulting future payments.

On the other hand, certain employers will request for you to submit a copy of your credit report during pre-employment screening to check your credit worthiness before making a hiring decision. Employers might also continue checking on existing hires to ensure they are financially competent and not in financial distress whilst in employment.

Components of a credit report

Here is a breakdown of the components you will find in your credit report, and how to interpret each section:

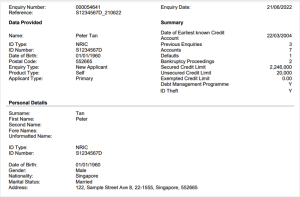

1. Personal Details

The first portion of the credit report will display a summary of your credit information, such as the number of credit accounts you currently own, previous enquiries, defaults, bankruptcy proceedings, credit limits, debt management programme and any reported ID Theft. Your personal data information such as Name, ID number, Date of Birth, Gender, Nationality, Marital Status and Address will also be reflected on your report.

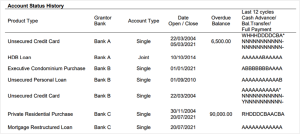

2. Account Status History

Account status history shows all the credit facilities you own.

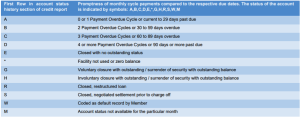

The last column shows the status of each credit facility, and is displayed on a rolling 12-month basis (most recent cycle on the left, and oldest on the right). Wondering what all these alphabets mean? Fret not – you can refer to the detailed list below for the description of each of the statuses.

Closed accounts that are no longer active will have the last 12 months’ payment status history as at the date of closure displayed for three years.

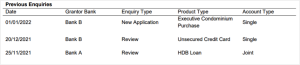

3. Previous Enquiry

Previous enquiry contains a record of all enquiries made on your credit report by credit providers or employers. A member of CBS may access your report for the following purposes:

1) if you have recently applied for a new credit facility – credit lenders will conduct a credit check on you before they approve or disburse any new loans or credit cards to you. This helps them to mitigate risks of new borrowers defaulting future payments.

2) for periodic review – depending on the credit lender’s risk appetite, some might choose to conduct a mass review of all their existing clients at least once a year.

3) for guarantor checks – if you agree to be a guarantor for someone, you will be liable to pay off the outstanding debts on his/her behalf. The credit lender will do a credit check to ensure that the guarantor is able to repay the debts should the borrower be incapable of repaying it in the future.

This information will be retained in the credit report for two years from the date of enquiry.

Depending on the type of enquiry made, it may or may not have an impact on your credit score. For example, too many enquiries for a new credit application within a short period of time may negatively impact the credit score as you would appear to be highly credit hungry or in urgent need of fast cash. On the other hand, periodic review and guarantor checks are unlikely to have a huge impact on your credit score.

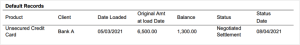

4. Default Records

Default records contain records of payment default reported by members of CBS. These records are displayed in the report for different durations depending on the type of default:

- Displayed for three years from status date: Negotiated Settlement or Full Settlement records

- Displayed for five years from date of discharge: Bankruptcy Proceedings

- Displayed Indefinitely: Outstanding, Partial Payment and Sold off records

To understand more about each type of default, you can view a sample credit report with explanations here.

5. Bankruptcy Proceedings

The bankruptcy records are sourced from Insolvency & Public Trustee’s Office (IPTO). In line with IPTO’s data retention period, this information will be retained in the credit report for five years from the date of discharge from bankruptcy.

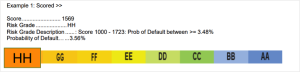

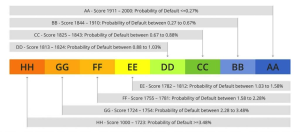

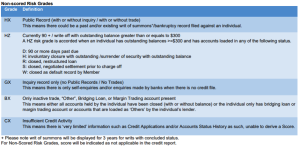

6. Bureau Score

The Bureau Score indicates your risk level at the time of enquiry. Calculated from an algorithm based on your current credit data, this number will change in tandem with changes in your credit information.

The Bureau Score ranges from 1000 to 2000 for risk grades AA to HH. The lower the Bureau Score, the higher the probability of default. If you see an AA on your report, congratulations on having a good credit score!

Score and non-scored risk grades are further explained in the table below.

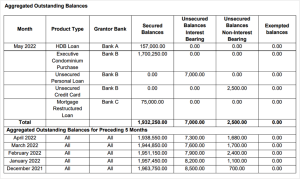

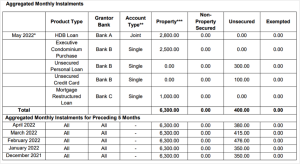

7. Aggregated Outstanding Balance and Aggregated Monthly Instalment

On the last section of the report, you will see a detailed breakdown of the Aggregated Outstanding Balance and Aggregated Monthly Instalment for the most recent month, and a summary view of the preceding five months. The data is grouped by Interest and Non-Interest-Bearing Balances for Secured and Unsecured credit facilities.

If you’re wondering how a credit report looks like in entirety, check out a full sample credit report with detailed explanations over at this handy website!

Importance of having good credit health

Good credit health mirrors you as a reliable and trustworthy individual who honours your financial obligations, giving you an advantage when seeking a job or applying for a loan.

Where can I get a copy of my credit report?

To check your credit score, you can purchase a copy of your credit report here.

This article is contributed by Credit Bureau Singapore.