When it comes to how much people earn in Singapore, one question often lingers: Am I earning enough compared to others? Unsurprisingly, it’s a perfectly normal question—and the answer isn’t a simple number.

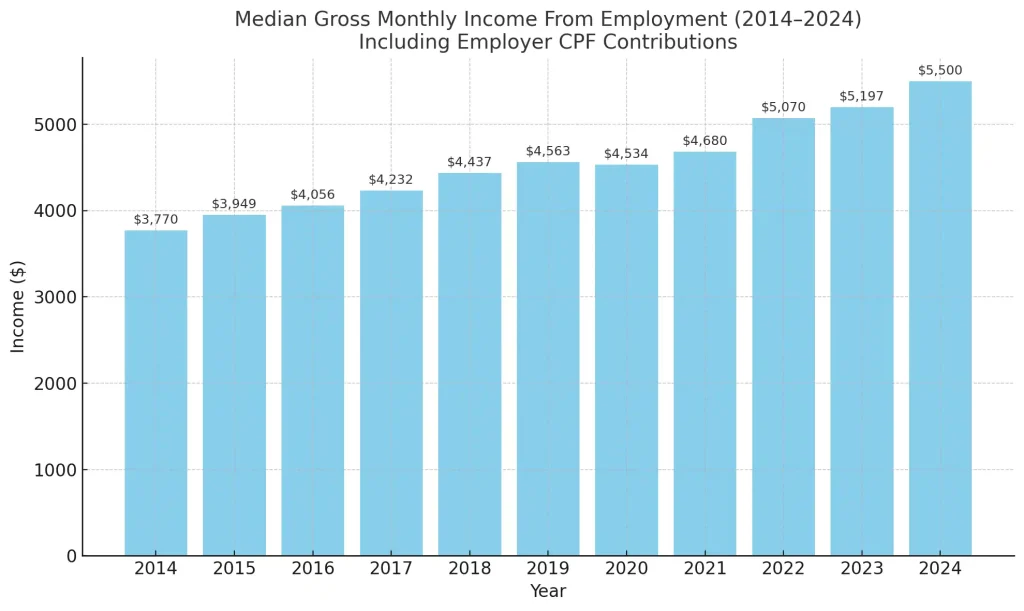

We often hear about the “median salary” in the news or from government reports. For instance, in 2024, the real median income of full-time employed Singapore residents rose by almost 6% to $5,500 per month.

Sounds promising, doesn’t it? But if your salary doesn’t come close to that number, don’t panic. The median salary isn’t a rulebook for success – it’s a benchmark. And it doesn’t tell the full story.

Median salary: What it is…and isn’t

Let’s keep things simple (no complicated math here, we promise). The median salary is the middle number in a list of all incomes sorted from lowest to highest. This means half of all full-time workers earn more than the median, and half earn less. Unlike the average salary, which a few very high earners can skew, the median provides a more accurate picture of what most people actually make.

But even though the median is a more reliable indicator of typical earnings. It still doesn’t account for everything. It doesn’t factor in things like your age, industry, experience, education level, working hours (full-time vs part-time), or even your personal household situation.

So, if your salary falls below the median, don’t worry. It doesn’t mean you’re failing or falling behind. Everyone’s journey is different, and the median doesn’t capture the full context of your career, responsibilities, or future goals.

What is the median salary used for?

Although the median salary might not reflect your journey, it plays an essential role in shaping national policies and economic planning. Here’s how:

Policy design and evaluation: Government schemes like Workfare and support grants often use the median salary to set income eligibility thresholds. It helps policymakers identify who may need more assistance or targeted interventions.

Tracking economic progress: The median salary indicates wage growth and income distribution. When lower-wage workers see faster income growth than the median, it signals narrowing income inequality — a positive trend in 2024.

Business and labour market insights: Employers and HR professionals use it to benchmark compensation packages and understand wage competitiveness.

Public communication: It offers a simple reference point for the media and public to grasp broad changes in income trends, without being distorted by outliers.

Think of the median salary like a weather report. While it gives you an idea of the overall climate, you should still check the forecast before deciding what to wear.

Why your experience might differ

When you hear the median salary, you might think, “Wait, I’m earning less. Am I below average?” Not necessarily.

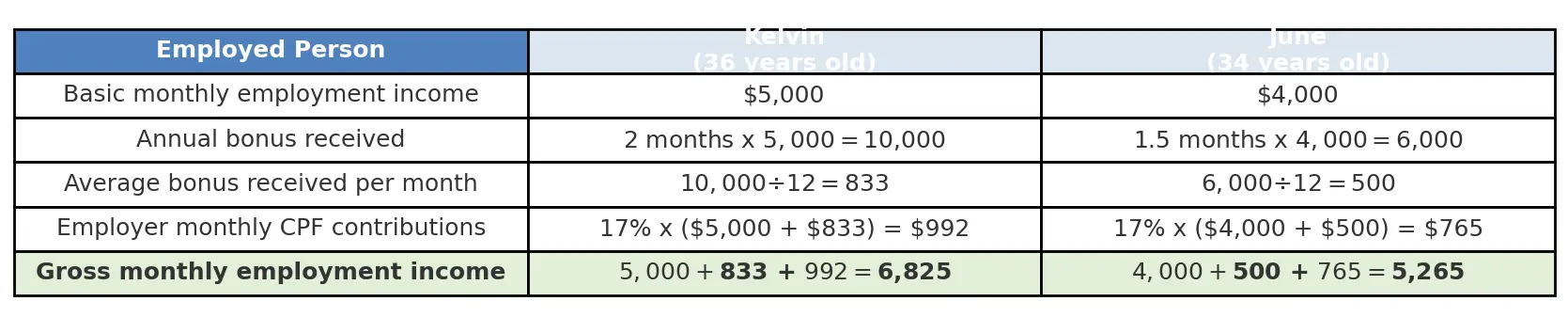

Let’s take Kelvin and his wife, June, a real-life example adapted from the Singapore Department of Statistics. Kelvin earns a basic monthly salary of $5,000, and June earns $4,000. When you factor in bonuses and employer CPF contributions, their gross monthly household income becomes $12,090. Sounds like they’re doing well above the median household income of $11,000, right?

Calculation of monthly employment income: Kelvin and June

But here’s the catch—they live in a household of five: their young son and Kelvin’s retired parents. When you divide their household income among the five members, the income per person becomes $2,418. That paints a very different picture.

In other words, how you feel about your income depends on more than your paycheque. Household size, dependents, living costs, and housing type shape your experience.

Beyond the numbers: Life phases and job sectors

As the saying goes, “numbers don’t lie,” but it’s essential to consider how income varies widely depending on life stage and job sector. For example, a fresh social work graduate earning $3,000 is not directly comparable to a tech lead making $8,000. Similarly, someone re-entering the workforce after taking time off may begin at a lower salary than the one they had before.

The median doesn’t show these personal stories, career detours, or trade-offs, which is essential because success looks different to everyone.

Also, the median figure you hear often reflects the salary of only full-time employed residents and excludes part-timers, gig workers, or those in transition. So, if you’re freelancing, switching careers, or working part-time, your income may not align with the median at all.

Focus on your career health, not just the numbers

A bigger salary won’t necessarily make you happier at work. Instead of fixating on how your salary compares to a national figure, ask yourself:

- Are you gaining skills that will help you grow?

- Do you have opportunities to advance or switch industries?

- Are you able to meet your financial needs and goals?

No single number – whether it’s a median or otherwise — can define your career health or potential. Understanding your situation, identifying your growth areas, and planning your path forward is more important.

If you’re feeling stuck or unsure where you stand, tools like CareersFinder by MyCareersFuture can help you explore jobs and training courses based on your current skills, giving you data-driven clarity and direction.

Salary: Not a benchmark for your career success

The median salary is not a scoreboard — it’s just a snapshot. While it provides insight into income trends in Singapore, your personal experience may differ, and that’s perfectly okay.

The truth is, there’s no such thing as a “normal” salary. What’s typical for one person may not reflect another’s reality. Income can vary widely based on industry, career stage, household size, or life choices. A lower-paying role might bring great purpose, while a high income may come with trade-offs.

Ultimately, focusing on your career health and long-term goals is more important. Your career is uniquely yours, and only you get to define what success looks like for you.