We get it: it’s the season of bonuses and revelry, and for some workers, lull and low-tempo periods. No one wants to think so far ahead to the next year — they’re simply enjoying rounding off this one so far.

But before we know it, the festive celebrations will be over, and we’re heading straight into the new year. What’s next for the job market, our career opportunities, and the bread and butter question: our salaries?

Here’s a quick sampling of tea leaves by various recently released reports so far.

Singapore’s Ministry of Manpower: Labour demand expected to soften

According to MOM’s Labour Market Q3 2025 report released in December, this year’s labour market performed stronger than anticipated, with total employment growing at a faster pace, while unemployment and retrenchments remained low.

Although economic uncertainties have receded since the first half of 2025, it remains elevated and will continue to weigh on firms, pointing to a moderation of labour demand.

Stay informed and secure. Navigate your job search confidently with MyCareersFuture.

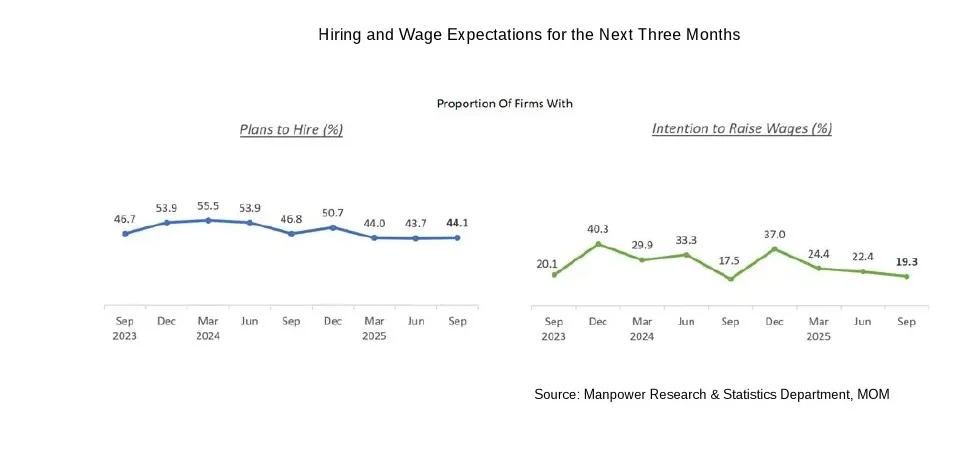

Looking ahead, labour demand is expected to soften. Business expectations for 1Q 2026 point to fewer firms planning to hire or raise wages in the coming three months.

At the same time, planned redundancies in the next three months have risen – from 1.9% across all firms in June to 2.3% in September, reflecting the continued uncertainty in the global environment.

Outward-oriented firms continue to show relatively stronger hiring intent, although they are less likely than domestic-oriented firms to raise wages.

Randstad: Employers focused on cost and efficiency, and crucial integration of enterprise AI

Randstad: Employers focused on cost and efficiency, and crucial integration of enterprise AI

According to Randstad Singapore’s 2026 Market Outlook and Salary Guide, companies are expected to maintain their talent strategies in the new year as they continue to focus on cost optimisation and productivity efficiency.

In this environment, employers will have to recognise that the success of recruitment will hinge on their investments in specific growth sectors, AI adoption, and a renewed push to build employer brand reputation.

Their latest research also revealed that generative AI applications are most adopted among local employees, with 70% using them for content creation, such as writing emails and reports.

Despite strong engagement with publicly available tools such as ChatGPT, enterprise-level AI adoption remains low.

This disparity indicates a maturity gap in workforce readiness, particularly in industries facing more automations and AI integrations like Construction, Manufacturing, and Banking & Financial Services.

This aligns with the national focus outlined in Singapore’s AI Strategy 2.0, which calls for a shift from basic awareness to deep, enterprise-level AI integration.

Employers can help bridge this gap through targeted investment in structured AI training and integration of enterprise-grade solutions, ensuring that all workforce segments are equipped to capitalise on AI’s transformative potential.

Job vacancies and salary expectations

Employers face a continuously tight labour market:the ratio of job vacancies to unemployed persons is at 1.35 (as of 30 June 2025). This means that there are 135 job vacancies for every 100 unemployed persons in Singapore.

The average monthly recruitment and resignation rates have also dropped in Q2 of 2025, reflecting as 1.6% and 1.1% compared to 2% and 1.3% respectively in the same period last year.

Find your next job now on MyCareersFuture. 100,000+ jobs updated daily!

Turnover rates remain low compared to historical averages, suggesting that employees in Singapore are exercising more caution about switching jobs amid ongoing economic uncertainty even in a relatively active hiring market.

According to our recent survey, 41% of respondents are keen to switch jobs, but only if they chance upon a better job opportunity, for there are no strong push factors.

Meanwhile, 43% of job seekers say they are considering a lateral move, compared to 28% who believe they can secure both a promotion and pay rise. This marks a lower appetite for advancement among the local talent pool compared with periods of stronger economic confidence.

Reeracoen: 2026 hiring will be for replacement, not expansion

According to the Reeracoen’s Singapore Salary Guide 2026, Singapore’s labour market outlook in 2025 was uneven yet positive — domestically oriented sectors such as Health & Social Services and Financial Services expanded, while outward-oriented industries like Information & Communications and Professional Services slowed.

Their guide forecasts a 4% to 4.3% average salary growth in 2026, reflecting a market cooling into sustainable balance. For employers, that means competing through retention and skill development — not just pay rises.

Reeracoen CEO Kenji Naito observed that the average recruitment-to-resignation ratio has almost doubled from pre-pandemic levels, which suggests that companies are hiring primarily for replacement than expansion.

The year ahead will continue to test balance, between retention and renewal, between automation and upskilling, and between cost management and talent motivation, he added.

“Across Asia, our regional data shows a 12-18% premium for candidates who combine technical fluency with soft skills such as leadership, adaptability and language proficiency — a clear direction for where Singapore’s next workforce transformation lies.”

PERSOL Singapore: Skills-first to be a focus for many industries

Forecasting salary increments averaging between 3% to 5%, PERSOL’s Salary Guide 2026 differentiated growth patterns influenced by accelerating technological adoption, skills-based hiring practices, and shifting employee expectations.

Among the notable market evolutions are the rise of AI-driven recruitment tools and an emphasis on hybrid work models, both of which are reshaping talent acquisition and retention strategies in unprecedented ways.

Key sector highlights include:

- Technology: Reports robust salary growth of 8-12% in specialised roles such as AI, cybersecurity, and cloud computing professionals. The proliferation of remote and flexible work options is reshaping candidate expectations and workplace dynamics.

- Healthcare & Life Sciences: Driven by demographic shifts and digital innovation, the sector sees growing demand for clinical researchers, regulatory specialists, and med-tech engineers, with competitive premium salaries in emerging hybrid roles.

- Financial Services: Emphasising digital transformation and sustainable finance, the sector offers salary premiums to professionals blending finance expertise with AI automation, ESG compliance, and hybrid operational capabilities.

- Professional Services: Including legal, consulting, and accounting, this sector values cross-disciplinary skills, especially in sustainability advisory, compliance, and digital transformation, with salaries growing steadily.

- Manufacturing & Engineering: Transitioning toward high-value precision production, roles in robotics, industrial automation, and advanced manufacturing command salary premiums tied to Industry 4.0 adoption.

- Education: An emphasis on edtech, personalised learning, and international schooling drives higher compensation, rewarding educators and administrators with digital fluency and innovative teaching capabilities.

- Transportation & Logistics: Growing use of digital platforms and sustainable solutions fuels demand for logistics technologists, supply chain optimisers, and operations managers, with salary growth outperforming traditional roles.

- Construction: Moderate growth with increasing focus on green building standards and digital construction technologies, boosting compensation for specialists in sustainable architecture and project management.

- Retail & F&B: Recovery, underpinned by the Progressive Wage Model, has driven wage growth at lower levels; meanwhile, premium pay is reserved for omnichannel retail strategists and niche culinary talents adapting to evolving consumer trends.

Manpower Group: Hiring, salary increments and bonuses are moderating

According to Manpower Group’s recent report on Singapore Salary and Bonus Plans, 45% of employers plan to award bonuses of exactly one month in 2025/2026, an increase of 3% year-on-year.

However, only 11% of employers will award bonuses of more than one and a half months, a decrease of 1% year-on-year.

In addition, looking forward to 2026, only 23% of employers intend to increase salaries by more than 5%.

Linda Teo, Country Manager of ManpowerGroup Singapore shared that local employers are exercising greater caution amid economic uncertainties.

“We’re seeing more employers moving toward smaller increments and smaller bonuses,” she added.

This trend reflects broader market practices of balancing cost management with fair rewards, including variable payments that recognise performance and employee contributions.

These calibrated measures help businesses navigate uncertainty while supporting workforce well-being and long-term organisational sustainability, she believes.

In terms of the sectors with more competitive increments, Manpower Group found that 33% of employers in Construction & Real Estate, and 27% of employers in Finance & Insurance are more likely to give increments of above 5% in 2026.

Employment outlook differs for various industries

Manpower Group’s 2026 Employment Outlook Survey also revealed that employer sentiment for hiring will decrease in Q1 2026, with more details on the following industries:

Industries with improved hiring outlooks

- Hospitality

- Finance and Insurance

- Construction and Real Estate

- Tech and IT services

Industries with a decline in hiring outlook

- Information

- Trade and Logistics

- Public Sector, Health and Social Services

- Utilities and Natural Resources

- Manufacturing

Professional, Scientific and Technical Services’ outlook remained the same compared to the previous quarter.

Robert Walters: Internal mobility may be the way forward

According to Robert Walters Salary Survey Guide Singapore 2026, given rapidly emerging job requirements arising from technological advancements, a skills-based approach will prevail in hiring and workforce management.

Businesses will continue to focus on internal mobility and talent development programmes.

Hire smarter, faster! Use MyCareersFuture’s innovative tools to find the right fit in record time.

Besides boosting talent retention rates, these initiatives also help companies build resilient teams equipped with the skills needed for the future.

Additionally, contracting and project-based hiring will dominate as businesses seek agility amidst cost pressures and market volatility.

Here are some other key salary insights their guide revealed:

- 97% of businesses are giving pay rises in 2026

- 74% of professionals are looking for a new job in 2026

- 6 years is the average tenure of professionals in a role

- 47% of professionals are confident about job opportunities in their sector

- 87% of professionals are expecting a pay rise in 2026

Salary increment culture is changing

In their Hiring in Singapore: Guide and Trends in 2026 report, Kirsty Poltock, Country Manager at Robert Walters Singapore elaborated. “Due to cost-of-living pressures, the days of market-wide increments are long gone.

“Salary growth has been stagnant in many domains, and job seekers in slower sectors had to contend with weaker hiring appetite and more contract positions.

“Mid-career workers were more incentivised to reskill because AI-savvy candidates have more opportunities in the market.

“Only specific, in-demand niches enjoyed sizable compensation and higher career mobility.”

She advises professionals embarking on a job search to adjust their expectations around wage growth.

“Unless the role sits in a high-demand niche, most jobs will not command pay increments of 20% or more. This comes on top of employers finding current candidate expectations too high to meet,” Kirsty said.

“Therefore, candidates should be strategic and realistic when negotiating. Make your salary asks based on market demand and salary benchmarks for the role, and be ready to articulate non-monetary value that you bring to the table.”

Actively looking for your next role? Follow us on LinkedIn for job-search tips, hiring trends and updates on WSG programmes that can support your journey.

Follow Workforce Singapore on LinkedIn

Stay informed, stay prepared – and give yourself an edge in your job search.