While it was clear there was a trend towards greater resignation numbers last year, with the battle against Covid-19 showing some headway and economic indicators improving, new job opportunities have arisen.

In fact, Singapore’s labour market has been steadily recovering the past year, and last month, the Manpower Ministry said the full-year unemployment rate dropped to 2.6% overall, down from 3%.

In addition, even how we work has evolved, with the digitalisation of both our workplaces, as well as the very nature of how businesses operate evolving.

The Singapore government is well aware of the challenges for both employees and employers to match these changes.

Finance Minister Lawrence Wong said during his delivery of Budget 2022 in Parliament on February 18: “As I made my final edits to the Budget statement, I recalled how COVID-19 has changed and impacted the way we live – our working lifestyle, jobs, social fabric, and most importantly, health.”

He added: “This Budget is for our people, our families, and our future generations. It will set out how we can better position Singapore for future challenges and opportunities.”

In total, $500 million for a Jobs and Business Support Package will be set aside to support both workers and businesses in segments of the economy that are facing slower recoveries.

In addition, the Jobs Growth Incentive, which supports employers to expand local hiring, will be extended by six months to September 2022. The scheme was first announced in August 2020 and was initially set to end in March 2022.

Minister Wong said to Parliament: “This extension will only cover those who face greater difficulty finding jobs, such as mature workers aged 40 and above who have not been employed for six months or more, persons with disabilities and ex-offenders.”

Mid-career switchers: Time to upskill

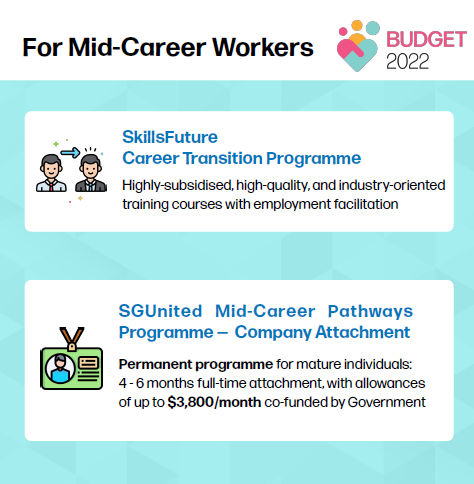

In addition, Minister Wong also announced measures that would enhance mid-career training programmes.

The SkillsFuture Enterprise Credit Scheme is designed to help employees provide industry-relevant training to workers. However, previously only employers that had at least three local employees, who also contributed to at least $750 of Skills Development Levy over a qualifying period were eligible for the scheme.

However, it has been announced that these requirements have been waived from a qualifying period for the whole of 2021. This will double the number of employers eligible for the scheme to 80,000.

In addition, the SGUnited Mid-Careers Pathways Programme, which provided company attachments for mature mid-career workers, got a boost with these opportunities set to be permanently provided as part of the various assistance schemes provided.

A new national scheme called the SkillsFuture Career Transition Programme will begin from 1 April 2022 and replace two of the schemes that were introduced in 2020: the SGUnited Skills Programme and the SGUnited Mid-Career Pathways Programme — Company Training, which will expire on 31 March 2022.

The scheme will provide jobseekers with highly subsidised, industry-oriented training courses that could enhance their career opportunities and support them in securing jobs in sectors with good prospects.

And if a jobseeker needs help right now…

These complement other local services offered to jobseekers to help them find the right career quickly, such as Workforce Singapore’s Career Matching Services, which aids those starting their first jobs, looking for career changes, or rejoining the workforce.

The programmes and resources available to support jobseeker’s career development include:

- Access to quick career tips to ace interviews and speed up job searches

- MyCareersFuture jobs portal to help jobseekers search and apply for jobs that match their skills

- Career GRIT: an easy yet structured job search guide that can support you in navigating career resources at any stage of your job search journey.

Older workers get a savings boost…

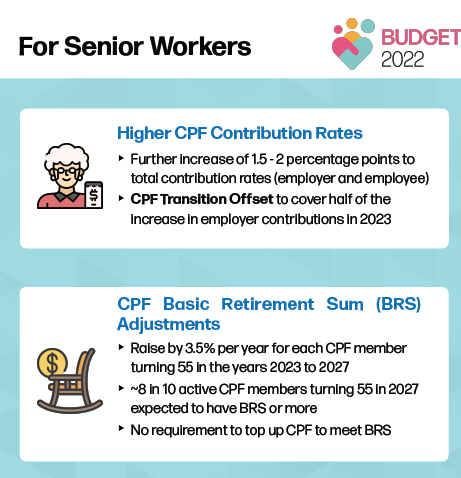

Other plans announced by Minister Wong included plans to raise higher Central Provident Fund (CPF) contribution rates, which will aid retirement plans for Singaporean workers.

Essentially, workers aged above 60 to 65 will have 20.5% of their wages going into their CPF accounts from January next year, an increase of 18.5% now.

While this may mean a slight decrease in take-home pay, the Government will also be continuing with this second crease in employer and employee contribution rates for senior workers aged 55 to 70 in 2023. This will mean a greater retirement nest egg for Singaporean workers in the future.

…while lower-wage workers get one for their salaries

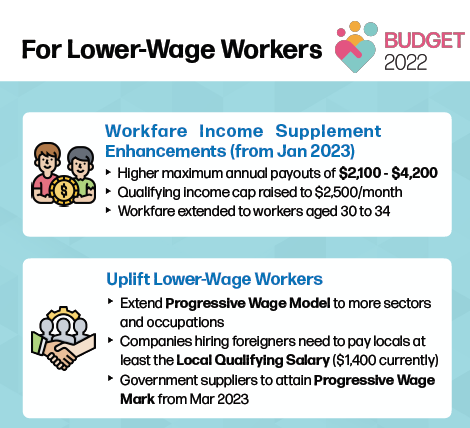

Another support measure announced at the Budget is an enhanced Workfare Income Supplement scheme. Payouts will be raised across the various age groups, and eligible employees will receive higher payouts of up to $4,200 annually, an increase from $4,000.

From next year, the scheme’s qualifying income cap will be raised from $2,300 to $2,500 a month. It will also be extended to younger workers aged 30 to 34, who will receive a maximum annual payout of $2,100.

Those aged 35 to 44 will receive a maximum annual payout of $3,000, while those aged 45 to 59 will receive a maximum annual payout of $3,600.

Those aged 60 and above will receive the highest maximum payout tier of $4,200 annually. This maximum payout tier will also be extended to all persons with disabilities, regardless of their age.

Workers will receive these funds via CPF top-ups, as well as cash as supplements to their income.

In total, $9 billion will be spent over five years to help support and raise salaries for lower-wage workers, Minister Wong said in his Budget speech.

This is likely to benefit more than half a million workers and targets those whose earnings are in the bottom 20%. For younger workers, this will allow them to start saving for housing and retirement earlier in their careers, he added.

The goal is better wages for local workers

Apart from the Workfare Income Supplement scheme, a new Progressive Wage Credit scheme will also be put into place that will help businesses transition towards better wages for Singaporean workers.

Under the scheme, the Government will co-fund the wage increases of lower-wage workers between 2022 and 2026. For workers earning up to $2,500, the co-funding rate will be 50% in the first two years, 30% in the next two years, and 15% in 2026.

There will also be some support for workers earning above $2,500 and up to $3,000, at a lower co-funding ratio.

Read More: How Mature Workers Can Stay Relevant in the Workforce

Minister Wong revealed that these moves on progressive wages will cover around 94% of Singapore’s full-time lower-wage workers. The enhanced Workfare will also provide further support to all eligible Singaporean lower-wage workers.

With these schemes, the incomes of lower-wage workers are expected to grow faster than the median wage growth over the next decade.

“So as our economy grows and society progresses, we will reduce income disparities in our workforce,” Minister Wong concluded.